CalPERS Delays Scary Pension Reports Until After the Election

A senior CalPERS attorney just told me that the annual pension liability reports for local agencies, which are normally distributed every October, have now been delayed until after the November elections. The delays are allegedly due to furloughs, but conveniently prevent local pension watchdogs from using the data to promote fiscally conservative candidates and pension reform leading up to the November 2nd.

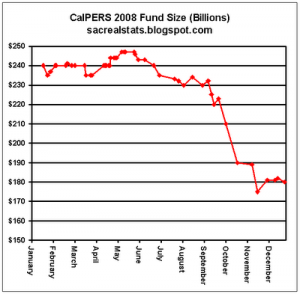

This year’s reports would be the first to calculate pension liabilities after the disastrous market crash of 2008/2009 which caused CalPERS to loose a large portion of its holdings, which in turn has caused cities’ unfunded liability and annual contributions to skyrocket. But the damage to each city is unknown until the individual reports are released.

How bad will it be? Here’s one example: rough calculations show Fullerton’s “non-smoothed” unfunded liability for itspublic safety plan will soar past $100,000,000 this year, nearly three times the amount presented last year. Throughout the state, the debts shown in these report are likely to be shocking compared to previous filings.

The data would have undoubtedly been used to draw more attention to the dire pension situation in cities throughout California. The reports would have come just in time for local elections, which makes CalPERS’ stated cause for the delay extremely suspect.

The annual “Actuarial Valuation” reports are prepared by CalPERS actuaries for each participating agency to justify annual increases in required contributions. Here is a example of Fullerton’s public safety report for 2008, which is the most recent year available.

$100 million for Fullerton cops? No big deal. They are heroes and deserve.

Why would such a delay surprise anyone …. CalPERS should simply be Administering Plan rules, not advocating for participants vs taxpayers (who pay the bills).

I find it hard to believe based on how this site is peppered with half-truths that any senior CALPERS attorney would even talk to big important Travis. I’m sure this whole blurp is just Travis’ take on why there is a delay. A conspiracy i say!

Maybe it’s hard for you to believe, but I talk to people above your pay grade every day. It’s part of the painful process of extracting turds of truth from the government sandbox.

I even gave you a link to the actual email and yet you still accuse me of lying. Nice.

What D-1 college did Tony play for?

I believe Wyoming

This is an editorial. So the writer is expressing his own personal opinion. Which the reader should know and does. Calpers motives as powerfully expressed here may or not be true. Take it as you see it.

However, your graph is intentionally misleading. While technically true, it verges on being a lie. A graph which would be meaningful would not trucate the dollars close to the low point for drama, but have a scale that starts with zero. It would also be current to as near to today as figures are available showing a considerable rebound in assets.

Ouch? Not as presented. Smoke and mirrors? I think so.

Charles, I couldn’t find a graph that shows the June 30, 2008 to June 30, 2009 asset loss. I used the closest thing I could find. It’s only varies slightly from the actual June to June massacre.

Thank you for replying. In this day and age, there are still people who appreciate courtesy.

Next time, look up the Calpers website, get the latest numbers and draw your own graph.

I still advocate changing your Y-axis.

Oh, and Calpers motive? I strongly suspect you are not playing a hunch. In fact I think you are spot on.

Again, thanks.

http://www.cnbc.com/id/39626759

This is a good read

This year’s reports would be the first to calculate pension liabilities after the disastrous market crash of 2008/2009

================

Hahaha…get ready, grab your ankles, it is about to hit the fan.

Fake OCO

Think again, where did that graph come from?

Those BASTARDS!

The term unfunded liability is meaningless. This is like your mortgage being all due now, today. It’s not. And it will be funded as you pay for it over time. These pensions are mostly paid for by the pension fund. Calpers is 220 billion strong. The last fy was a 11.4% rate of return. That’s excellent. The pension fund is doing fine it’s just adjustments that are required….. I hate this goofy nonsense !

Buck, you have no idea what you are talking about and your clearly don’t understand what the word “unfunded” means. Please take a Finance 101 class instead of reading your Calpers newsletters.