The Desperation Has Arrived

In case you weren’t already convinced, Tuesday’s study session agenda provides ample evidence that Jennifer Fitzgerald lied when she said Fullerton has a balanced budget. She also boasted during her campaign that Fullerton, unlike other cities, didn’t have special sales taxes because we manage our finances (better). Short of widespread cuts citywide, that scenario — city sales taxes — looks to be nearly inevitable in the near future:

While not part of the public budget workshop, the City Council will confer in Closed Session beforehand about the (likely) sale of 15 City-owned parcels across town:

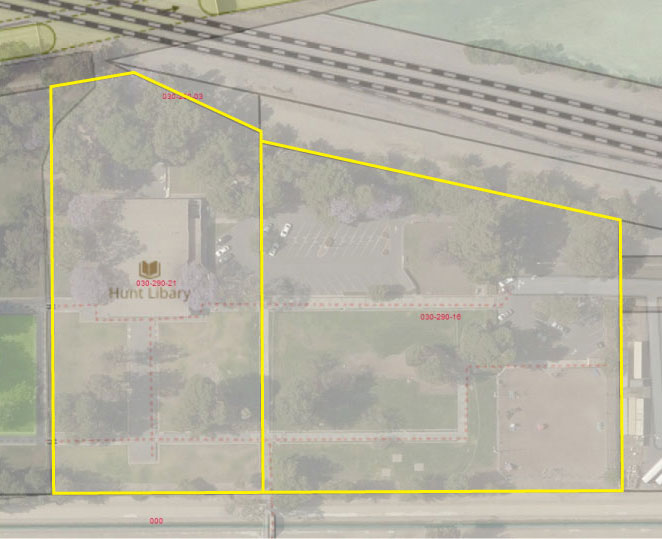

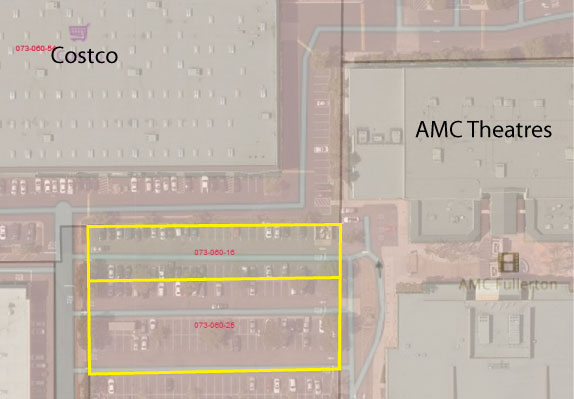

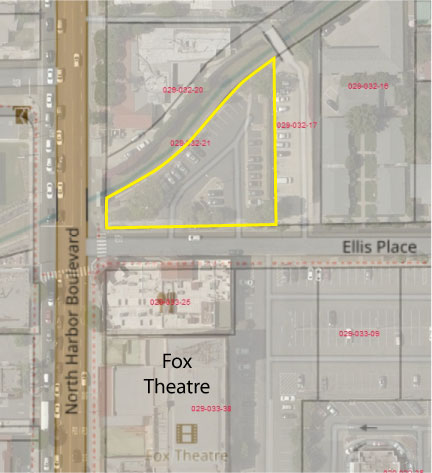

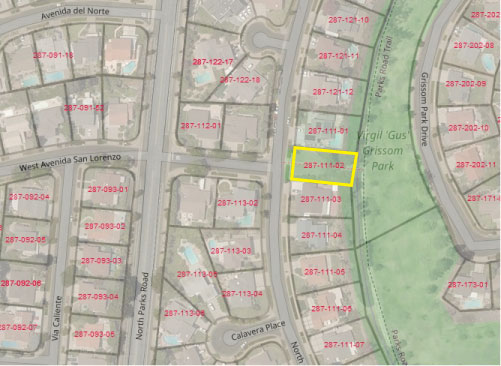

The City never provides more than a parcel number, so I’ve taken the liberty of capturing a screen shot of each parcel from the county’s GIS viewer and added a brief description.

After all, these are public assets. We deserve to know which parcels of public land City Hall is seeking to dispose of.

One doesn’t need to be a rocket scientist to realize some of this land should have been sold years, if not decades, ago. Other pieces of property, such as the Hunt Branch Library — a gift to the City — should give everyone pause to realize the gravity of Fullerton’s looming financial disaster.

Selling surplus assets provides short-term cash but does absolutely nothing to address long-term funding gaps. When there’s no more “surplus” parcels to flip for quick cash, what will the City do? Sell a bunch of City parks to a developer? Sell the main library? Sell the community center?

This is severe and it’s going to be painful for all Fullerton residents in the not-too-distant future. Our City Council has a choice to make: Radical changes for the residents in the form of tax and fee increases, and cuts in City services –or– Radical changes in the way City employee pensions are funded by the City. A choice has to be made — it’s one or the other.

What will they do?

Now we know why Sammy Han and Grace Ministries were so happy to pitch the Jennifer Fitzgerald Booze Map.

Disgusting. Jesus (Christ) will not be pleased.

JC threw the money lenders off the temple steps. Looks like we will have to also.

Lookit all those new high density housing projects. Lobbyist’s daydream. SparkyFitz, the gift that keeps giving!

Did I miss something? The decision to sell vacant parcels is a policy decision, right? Public hearing. Have they done that yet?

Fitzgerald Fire Sale! Everything must go!

Funds from the sale of land assets should only go towards capital improvements. This land belongs to the residents of Fullerton, not to city hall. Using these properties to shore up a faulty budget is really bad.

Fullerton is literally for sale.

Fullerton is not for sale.

Because it’s already been sold(out)?

RECALL

Why? Because Fitzgerald flat out LIED to the voters and doesn’t even have the decency to say she’s sorry?

Recall her for that little thing? Heavens no.

That’s just how they roll over at Pringle and Associates! Promote that woman! She’s single handily bankrupting a city of 140,000 people.

That’s moxy, baby.

Bring signs to the next meeting.

Just keep watching God’s plan while eating popcorn until you are not able to afford it anymore

https://youtu.be/xrkhsqw7bRQ

Thanks. That’s a post!

Thanks. I’m glad to share with FFFF

…. I’m not convinced yet https://i.imgsafe.org/132b16b887.jpg

tinyurl.com/zpox2rn

Fullerton, the city gobbled up by civil servant pensions and salaries, legal settlements to the victims or their families of Fullerton PD abuses and murder, cost of policing downtown Fullerton’s gangbang, drunk beat down nightly fest,, fiscal mismanagement by the masters degree only in sociology city manager Joe Felz, silly and selfish use of redevelopment funds to glorify Myopic vision of Fullerton city council. Meanwhile Fullerton’s water system rusts and rots under the city’s streets, while funds intended to preserve clean water for this town siphoned off into salaries for , you guessed it right, reader, salaries and pensions for Fullerton’ s elite, our public servants.

Nice summation. Thank you.

thank you

We have a winner! Correct on all accounts.

Good one!!!

I know what we can do with all this land…

https://youtu.be/KMU0tzLwhbE

As a native Fullertonian being born in the fifties at St Jude and a third generation former employee of Hunt’s i am appalled that the city has squandered the generosity of Norton Simon with this attempt to sell off the Hunt Library property.I remember riding the school bus from Commonwealth School to the opening of the Hunt Library.

This may seem a small thing but is indicative of the destruction of our once wonderful community where the Police force used to be made up of members of our community not a bunch of thugs that treat every citizen like a criminal.

Very sad.

“… not a bunch of thugs that treat every citizen like a criminal.”

But that can’t, or won’t control downtown Fullerton.

norton simon originally wanted Hunt Library to be an art museum. Typical of Fullerton, the then Fullerton city council voted against the museum idea saying it would cost the city too much money to maintain; compromised reached the Norton Simon museum resides in Pasadena and itsmintended site became a livrary designed by noted architect Peralta. Trust the city o Fullerton to trash what is good in and for Fullerton. Instead of art, culture, history, you know those things of beauty that never die, Fullerton has designed total booze bash downtown.

“One doesn’t need to be a rocket scientist to realize some of this land should have been sold years, if not decades, ago.”

More brilliance from Tony’s tool shed. The properties are worth 100 times what they were worth 30 years ago you idiot. Of course we have to sell these off. That is part of a sound business plan and the city is a corporation.

What do sound business plans have to do with anything? This teaspoon isn’t bailing anyone out of anything.

How funny. A “sound business plan?” Selling off assets in a distress sale? What kind of moron are you?

Obviously one of SparkyFitz’s feeble brain trust – or a Pringle client looking for cheap land to buid 5 story apartments on. A few million realized from selling all these assets won’t close the gap for a single year of Fitzgerald’s spending spree.

“The properties are worth 100 times what they were worth 30 years ago you idiot. ”

No, that’s addled nonsense (idiot). In net real terms the increase is about 100%. If they had been sold and the money invested the return over 30 years would be WAY higher.

Plus there would have been 30 years of property taxes collected. Oops!

Excellent point.

I see some GREAT locations for some SUPER HIGH RISE apartments!

I see some property being liquidated for good use and finally so. The city, like all the others, needs to move forward and take care of its obligations to maintaining public safety. That costs money.

And yet the cost of “public safety” is devastating the City’s finances. And look around. Do you see public safety? The cops can’t even control downtown Fullerton on a Saturday night and they admit it.

And check out the high cost of our heroes: millions of bucks paid out in settlements.

So we’re having our bank broken for no good reason at all. We’d be better having a bunch of chimpanzees wearing badges.

Yes. Jerm Popoff couldn’t bribe chimps with beer and shitty food.

Maybe they could turn one of those sites into a cemetery, where they can bury the remains of their fire & police pension obligations.

Two of the sites are worthless remnants from when Chapman morphed into Malvern. Fullerton Beautiful put xerascapes there years ago. Commercial value? $0.

Still a good place for Sergeant Schoen to set up his bong hut.

Love it!

Sergeant GED Moondoggie Shone’s Magical Bong Hit Hut. It could look like one of those little roadside surfer wigwams from the 1950s.

At tomorrow’s meeting, from the city of Fullerton website:

“… a comprehensive review of reserve policies, including restrictions on the use of reserves”

Fitzgerald deficits ????

LOL Fitzgerald always balances the budget. No need for restrictions on the use of reserves!

Tomorrow’s agenda from the city website

“Salaries and benefits constitute 74% of General Fund expenditures and the City’s largest expense in providing services. It is also the fastest growing expense largely due to increased pension costs. Accordingly it is important for the City to work with its labor organizations to identify ways to reduce employee-employer related costs…”

The 100 FPD top earners in 2015 approximate total cost: $20,700,000; mean or average per cop $207,000

In 2016 Fitzgerald & Co gave the cops steady raises for the next years. Cops’ overtime must be controlled and there are several structural, systematic ways to do so.

Yes, peak salaries have the most direct connection to pension costs. Cut salaries, save money, save your city.

On the other hand, raising salaries for 3@50 earners at this point is absolutely insane.

The state crushes even the most trivial local pension reforms.

The best pathway to reform is to contain all tax expansions and let all of the cities implode on their own.

From the City’s website, tomorrow’s agenda

“Cities are subject to actions of the Governor and State Legislature and those oftentimes result in increased costs at the local level.Whether as State mandates, policy directives or as indirect impacts of other public entities (such as Calpers), it is important that the City seek legislative relief wherever possible”

As Fitzgerald has used the City as her private playground, so has CalPers been controlled by a group feeding private investment industry bloodsuckers, to the degree that a courageous CalPers whistle-blower has been mortified and is being pushed to resign.

This is a excerpt from Smith’s article:

Workers and retirees dependent on CalPERS benefits, as well as public officials whose agency and municipal budgets hinge on the success of CalPERS investments, should be mightily concerned about an attack on the board’s most outspoken and inquisitive member. Jelincic’s real offense is that his determined questioning has uncovered flaws in the CalPERS staff’s abilities to manage a $300-billion investment portfolio and in the board’s ability to understand its investment choices…

“If you’re going to clean up CalPERS,” [University of Missouri-Kansas City law professor Bill] Black told me, “you need very forceful directors. California should appoint more people like Jelincic.”

Jelincic has roiled the placid waters of board meetings, and some board members don’t care for that. “The board members virtually never oppose the staff or board consensus,” says Michael Flaherman, a former board member who is now a visiting scholar in public policy at UC Berkeley. By attacking Jelincic, he says, “they’re venting their pique” at a member whose dissent has sometimes gained him national press…

The real danger of the campaign against Jelincic is that it might silence not only his voice, but that of others. “My fear is that it’s going to have a chilling effect on people on the board, but also on the staff,” says Andrew Silton, a former chief investment advisor to the state treasurer of North Carolina. “If you’re going to pay a price for raising questions, that’s not a good prescription for running a large investment organization. Disagreement is good for the investment process.”

B t w Fitzgerald has brought forth deals for companies headed by former private equity fund executives.

“One of the core tenets of finance is that extra risk-taking should be rewarded with higher returns over time. But for more than the last decade, typical investor portfolios of private equity funds haven’t delivered the additional returns, typically guesstimated at 300 basis points over a public equity benchmark like the S&P 500….To its credit, CalPERS has been cutting its private equity allocation. CalPERS had a private equity target of 14% in 2012 and 2013; it announced last December it was reducing it from 10% to 8%. Like so many of its peers, CalPERS hoped that private equity would rescue it from its underfunding, which came about both due to the decision to cut funding during the dot com era, when CalPERS was overfunded, and to the damage it incurred during the crisis. At least CalPERS is finally smelling the coffee.

However, even with these appalling results, CalPERS does have another avenue: it could pursue private equity on its own, which would virtually eliminate the estimated 700 basis points (7%) it is paying to private equity fund managers. CalPERS confirmed this estimate by Ludovic Phalippou in its November 2015 private equity workshop. Since at that point it had gathered private equity carry fee data, that means the full fees and costs are at least that high; it would presumably have reported a lower number or flagged the figure as an high plug figure. Getting rid of the fee drag would mean much more return to CalPERS and its retirees, and would make private equity more viable.

CalPERS has two ways it could go. One would be a public markets replication strategy, which would target the sort of companies private equity firms buy. Academics have modeled various implementations of this idea, and they show solid 12-14% returns. However, as we’ve discussed at length, and some pubic pension funds have even admitted, one of the big attractions of private equity is…drumroll…the very way the mangers lie about valuations, particularly in bad equity markets! Private equity managers shamelessly pretend that the value of their companies falls less when stocks are in bear territory, giving the illusion that private equity usefully counters portfolio volatility. Anyone with an operating brain cell knows that absent exceptional cases, levered equities will fall more that less heavily geared ones. So the reporting fallacy of knowing where you really stand makes this idea unappetizing to investors.

The other way to go about it would be to have an in-house team that does private equity investing. A group of Canadian public pension funds has gone this route and not surprisingly, reports markedly better results net of fees than industry norms. And this is becoming more mainstream, as Reuters reported last Friday (hat tip DO):”

High density housing!

Build 40 story buildings with no parking and no bus service there and house the homeless – two problems solved!!!

(time to move?)