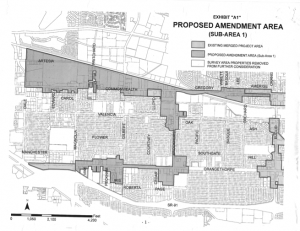

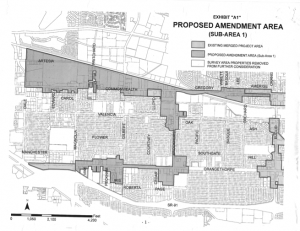

At its May 5 meeting, The Fullerton City Council will consider expanding the city’s redevelopment area by 1,165 acres. This would place nearly 25 % of the entire city under the redevelopment agency, with its expanded powers to use eminent domain, divert property taxes and subsidize development.

At its May 5 meeting, The Fullerton City Council will consider expanding the city’s redevelopment area by 1,165 acres. This would place nearly 25 % of the entire city under the redevelopment agency, with its expanded powers to use eminent domain, divert property taxes and subsidize development.

State law allows the creation or expansion of redevelopment areas for only one reason—blight.

Blight is a legal requirement. Without it, a redevelopment area can be thrown out by the courts, as has been done with the cities of Mammoth Lakes, Temecula, Glendora and Diamond Bar. Judges are loathe to allow more revenue diversion unless the law is respected. The proposed expansion would place much of Southeast and Southwest Fullerton’s commercial areas under redevelopment. Are they blighted?

The allegedly blighted area abuts my College Park neighborhood, along Raymond Ave. It includes a new Walgreen’s, the original Polly’s Pies and the Albertson’s where I shop. South of the tracks lies the newly-built Valencia Industrial Park, leased to near capacity, and the bustling Home Depot. It includes multinational distribution centers such as Yokohama Tire, UPS, Alcoa Aluminum and the Kimberly-Clark plant.

The allegedly blighted area abuts my College Park neighborhood, along Raymond Ave. It includes a new Walgreen’s, the original Polly’s Pies and the Albertson’s where I shop. South of the tracks lies the newly-built Valencia Industrial Park, leased to near capacity, and the bustling Home Depot. It includes multinational distribution centers such as Yokohama Tire, UPS, Alcoa Aluminum and the Kimberly-Clark plant.

The council is being asked to declare as blighted all 167 small businesses along West Commonwealth, stretching from Euclid to Dale. All of these business owners must realize that a blight designation automatically makes them subject to possible future eminent domain.

Also blighted would be the new Fresh’n’Easy shopping center at Euclid & Orangethorpe. The proposed blight includes the Fullerton Municipal Airport and adjacent aviation businesses. It includes unique regional specialty retailers on Orangethorpe like Bob Marriott’s Fly Fishing Store and the Harley Davidson Center, both the largest of their kind on the West Coast.

Also blighted would be the new Fresh’n’Easy shopping center at Euclid & Orangethorpe. The proposed blight includes the Fullerton Municipal Airport and adjacent aviation businesses. It includes unique regional specialty retailers on Orangethorpe like Bob Marriott’s Fly Fishing Store and the Harley Davidson Center, both the largest of their kind on the West Coast.

Urban Futures Inc. conducted the city’s blight report, which studied conditions in the proposed expansion areas. It found that out of 629 buildings, only 5% were deteriorating. Less than 2% of the all parcels are described as incompatible. In the proposed project area, sales tax revenues grew 50% faster than in the rest of the city. There is no blight to legally justify the expansion.

Expansion means the agency will divert even more property tax funds from local government. Statewide, 10% of all property tax revenues are diverted by redevelopment agencies—that’s $5 billion annually. Most of this is at the expense of public schools, which then must be backfilled from the state general fund. But the state is now broke, and the backfills can’t be maintained without the massive new tax hikes proposed for the May 19 ballot. Redevelopment also diverts funds from the city’s general fund with an estimated $100 million loss to the municipal budget over 45 years.

Expansion means the agency will divert even more property tax funds from local government. Statewide, 10% of all property tax revenues are diverted by redevelopment agencies—that’s $5 billion annually. Most of this is at the expense of public schools, which then must be backfilled from the state general fund. But the state is now broke, and the backfills can’t be maintained without the massive new tax hikes proposed for the May 19 ballot. Redevelopment also diverts funds from the city’s general fund with an estimated $100 million loss to the municipal budget over 45 years.

Here in OC, RDAs now consume 15% more property taxes than all of county government. The County of Orange has lost $190 million to redevelopment agencies since 1990. This translates into real cuts in public services. We must defend our public revenue stream against future diversions.

With these funds, RDAs typically assemble land (under threat of eminent domain) and subsidize new retail development. Costco alone has received $30 million in public money just in OC, while Walmart has gotten over a $1 billion nationally in tax subsidies. The promised revenues rarely materialize as sales taxes are simply shifted from one area to another. Subsidized corporate big boxes soak up the sales that used to go to small businesses.

In 1998, the respected Public Policy Institute of California conducted a comprehensive study of redevelopment areas throughout the state. This groundbreaking report “Subsidizing Redevelopment in California” found no net economic benefits that justified the huge public expenditures.

Compare the three shopping centers at Harbor and Orangethorpe: Metro Center and Fullerton Town Center received massive public subsidies, while Orangefair was built and recently improved with purely private money. Compare the Knowlwood complex at Harbor and Commonwealth (with its fake second story), built with $510,000 in RDA subsidies, next to privately built Stubrik’s and Slidebar.

Compare the three shopping centers at Harbor and Orangethorpe: Metro Center and Fullerton Town Center received massive public subsidies, while Orangefair was built and recently improved with purely private money. Compare the Knowlwood complex at Harbor and Commonwealth (with its fake second story), built with $510,000 in RDA subsidies, next to privately built Stubrik’s and Slidebar.

RDA funds can be used for purely public projects. While a member of the Fullerton City Council, I did vote for redevelopment funding for infrastructure, parks, libraries and the Maple School rehab.  But the temptation to get involved in purely private commercial ventures makes city government a major developer and landowner.

But the temptation to get involved in purely private commercial ventures makes city government a major developer and landowner.

Because of site-based sales tax allotment, cities typically use redevelopment to subsidize new retail centers. Auto malls, shopping centers and multiplexes have all been built with public funds. With retail centers now overbuilt and languishing, where is the market for all these new taxable sales? With property values plummeting, when will any additional property tax increment materialize?

Fullerton’s current RDA areas were created when blight standards were vague and unenforced. Subsequent laws require blight to be definitively proven. Judges have little tolerance for city governments simply seeking to expand power and revenue at others’ expense.

As a county official, I’m concerned about redevelopment’s impact on public services. As a Fullerton native, I’m concerned about an official declaration that 25% of my hometown is blighted. If redevelopment really has cured blight in our city, why does it continue to grow after 35 years? If there is no blight, why are city officials so eager to flout the law and denigrate Fullerton’s true condition?

At our June 17, 2008 meeting, the Orange County Board of Supervisors voted 5-0 to oppose the proposed Fullerton RDA expansion. The opposition was based on the feared loss of County revenues and County Counsel’s opinion that there is no blight to legally justify the expansion.

At its May 5 meeting, The Fullerton City Council will consider expanding the city’s redevelopment area by 1,165 acres. This would place nearly 25 % of the entire city under the redevelopment agency, with its expanded powers to use eminent domain, divert property taxes and subsidize development.

At its May 5 meeting, The Fullerton City Council will consider expanding the city’s redevelopment area by 1,165 acres. This would place nearly 25 % of the entire city under the redevelopment agency, with its expanded powers to use eminent domain, divert property taxes and subsidize development. The allegedly blighted area abuts my College Park neighborhood, along Raymond Ave. It includes a new Walgreen’s, the original Polly’s Pies and the Albertson’s where I shop. South of the tracks lies the newly-built Valencia Industrial Park, leased to near capacity, and the bustling Home Depot. It includes multinational distribution centers such as Yokohama Tire, UPS, Alcoa Aluminum and the Kimberly-Clark plant.

The allegedly blighted area abuts my College Park neighborhood, along Raymond Ave. It includes a new Walgreen’s, the original Polly’s Pies and the Albertson’s where I shop. South of the tracks lies the newly-built Valencia Industrial Park, leased to near capacity, and the bustling Home Depot. It includes multinational distribution centers such as Yokohama Tire, UPS, Alcoa Aluminum and the Kimberly-Clark plant. Also blighted would be the new Fresh’n’Easy shopping center at Euclid & Orangethorpe. The proposed blight includes the Fullerton Municipal Airport and adjacent aviation businesses. It includes unique regional specialty retailers on Orangethorpe like Bob Marriott’s Fly Fishing Store and the Harley Davidson Center, both the largest of their kind on the West Coast.

Also blighted would be the new Fresh’n’Easy shopping center at Euclid & Orangethorpe. The proposed blight includes the Fullerton Municipal Airport and adjacent aviation businesses. It includes unique regional specialty retailers on Orangethorpe like Bob Marriott’s Fly Fishing Store and the Harley Davidson Center, both the largest of their kind on the West Coast. Expansion means the agency will divert even more property tax funds from local government. Statewide, 10% of all property tax revenues are diverted by redevelopment agencies—that’s $5 billion annually. Most of this is at the expense of public schools, which then must be backfilled from the state general fund. But the state is now broke, and the backfills can’t be maintained without the massive new tax hikes proposed for the May 19 ballot. Redevelopment also diverts funds from the city’s general fund with an estimated $100 million loss to the municipal budget over 45 years.

Expansion means the agency will divert even more property tax funds from local government. Statewide, 10% of all property tax revenues are diverted by redevelopment agencies—that’s $5 billion annually. Most of this is at the expense of public schools, which then must be backfilled from the state general fund. But the state is now broke, and the backfills can’t be maintained without the massive new tax hikes proposed for the May 19 ballot. Redevelopment also diverts funds from the city’s general fund with an estimated $100 million loss to the municipal budget over 45 years. Compare the three shopping centers at Harbor and Orangethorpe: Metro Center and Fullerton Town Center received massive public subsidies, while Orangefair was built and recently improved with purely private money. Compare the Knowlwood complex at Harbor and Commonwealth (with its fake second story), built with $510,000 in RDA subsidies, next to privately built Stubrik’s and Slidebar.

Compare the three shopping centers at Harbor and Orangethorpe: Metro Center and Fullerton Town Center received massive public subsidies, while Orangefair was built and recently improved with purely private money. Compare the Knowlwood complex at Harbor and Commonwealth (with its fake second story), built with $510,000 in RDA subsidies, next to privately built Stubrik’s and Slidebar. But the temptation to get involved in purely private commercial ventures makes city government a major developer and landowner.

But the temptation to get involved in purely private commercial ventures makes city government a major developer and landowner.