Some of our loyal readers have asked about the 3 @ 50 pension formula that many, if not most “public safety” employees receive. It’s pretty simple. You get to retire at age 50. The 3 is a multiplier applied to the number of years you have been employed. The guy or gal who works for 30 years would get 90% of his or her highest salary as a pension. For life. Pretty sweet gig, eh?

Many public agencies also tack on other benefits as income, boosting pensions even higher. The worst scam of all is foisted on the public by the agencies that consider the taxpayer’s payment of the employees’ share of pension paycheck deductions as income counted toward their pensions. This charming little ripoff is known colloquially as “PERS on PERS,” PERS being an acronym for Public Employee Retirement System.

So, what is the tie in to Fullerton?

Well, let’s start with the Three Dyspeptic Dinosaurs, Bankhead, Jones, and McKinley. Back in 2001, at the behest of Andy Goodrich and his union, these two voted to give the 3 @50 formula for the Fullerton Police and Fire Departments. The decision was voluntary and wittingly done. If that weren’t bad enough, of course the benefit was applied retroactively, meaning that many cops and firemen who had worked for decades under the previous formula were suddenly handed a titanic bonanza of taxpayer confiscated wealth, with the single stroke of Mayor Don Bankhead’s pen. And that single stroke of glaring incompetence has contributed to a massive unfunded pension liability that Fullerton citizens will have to carry indefinitely.

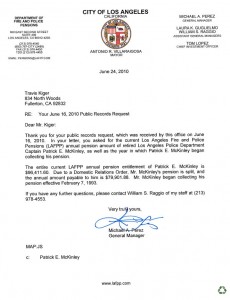

And who is one of the principle beneficiaries of this generosity with the public purse? You guessed it. Former police Chief and current councilman Pat McKinley, who has picked up the moniker “Pat McPension” for his $215,000 a year pension – far more than he ever made working.

Now this profligate behavior with public funds is typically the sort of behavior attributed to liberal Democrats. In Fullerton the heist was perpetrated by allegedly “conservative” Republicans who believe wearing stupid lapel pins is what really matters. Well, they sold us out, folks.

Bankhead, Jones and McKinley.