As the Davis Vanguard does, here.

Friends For Fullerton's Future

FFFF supports causes that promote intelligent, responsible and accountable government in Fullerton and Orange County

As the Davis Vanguard does, here.

Here’s a fun repeat-post from last spring – featuring two of 4SD Observer’s favorite idols: emergency service providers and the dim-witted Pam Keller. For sheer fat-headedness, selfishness, and fiscal irresponsibility, you just can’t beat the ESP union.

– Joe Sipowicz

Pam Keller was the only city council member who did not have the guts to impose a %5 pay reduction on members of the Fullerton firefighter’s union after negotiations failed on Tuesday. The union refused to accept a deal similar to those offered to all other Fullerton employees.

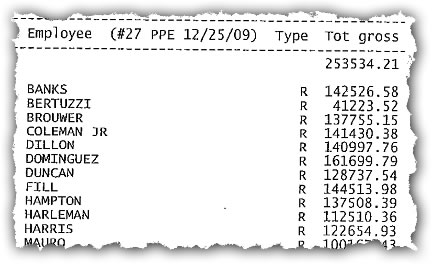

The union says the pay cut is unfair. Is that true? Let’s see what firefighters actually took home last year:

View the 2009 Fullerton Fire Dept payroll

View the 2009 Fullerton Fire Dept payroll

In addition to the gross pay numbers above, firefighters receive the following estimated benefits at the city’s expense:

Pension contribution: ~30% of base salary. Ranges from $15,000 to 28,000/yr, not including unfunded liabilities

Medical: $5,460 to $14,748/yr

Dental: $588 to $1,128/yr

Not a bad gig. It’s no wonder there are hundreds of applicants whenever a position opens up.

Does Keller really think that asking this highly compensated group of public employees to take the same pay cut as everyone else was “unfair?’

Or perhaps Pam is just sticking to what Pam does best: Helping folks suck as much as possible out of the public trough. By any means, at any cost.

Last week we presented this hilarious dialog between a distraught taxpayer and a union firefighter, which became an instant hit across the country. While the clip had no problem making it onto the workstations of public agencies far and wide, we also had many requests for a G-Rated version.

Despite our concern that self-censorship may inhibit the fine directorial talents of our anonymous Oliver Stone, he was happy to oblige:

Of course, most will probably prefer the original profanity-laced version here: Stop the Madness Now!

That’s what members of Fullerton’s police and fire unions get from us.

Almost all of the candidates are talking about pension reform now, but they don’t quite have their figures right. According to the city’s HR Director, public safety employees currently pay 2.557% of thier salaries towards their multi-million dollar retirements, while taxpayers pick up the rest. This year, we’re paying an additional 29.752% of their salaries towards their retirements, and it’s set to shoot much higher.

In private-sector terms, that’s equivalent to an employer 401(k) match of 1200%. That’s twenty-four times the average out here in the real world.

Author Steven Greenhut delivers a dismal report for those looking for pension reform to come out of the state legislature: It ain’t gonna happen. Cities and schools must save themselves.

http://www.youtube.com/watch?v=ujCwsG4P9ZIBut we are still the masters of our fate. If we move quickly, there are things that can be done to prevent this financial disaster from passing on to our children, although they will require unconventional courage, wisdom and action. So who’s going to step up to the plate and rescue Fullerton?

Last year CalPERS reported that the city of Fullerton is facing an unfunded pension liability of $37,531,831 on our public safety employees’ retirement plan. That’s the amount that we currently owe our public servants above and beyond all future budgeted payments.

Of course, many professional actuarials believe that CalPERS’ figures are purposefully understated. They’re just being nice. What we’ve learned over the last few years is that CalPERS and the unions have been feeding our politicians a big fat load of lies, which were used to pump up their pensions. The figures are derived from proven unrealistic investment returns that can never be achieved. Studies conducted by Stanford grads and the NCPA agree.

So we asked an industry insider to recalculate Fullerton’s unfunded pension liability using a realistic rate of return for a government pension system. While he could not do a detailed actuarial report for our city, he stated that using a more realistic 5% long-term rate of return “would raise the unfunded liability by somewhere between 60% to 120% in most pension systems.”

Based on those figures, it’s safe to say that Fullerton’s real unfunded pension liability is somewhere between $60,000,000 and $83,000,000. That’s just for the police and fire unions, which has about 250 currently employed members.

Wrap your head around that. Sixty million dollars of unfunded, unplanned debt just for our little city of Fullerton. That money will not be spent on roads, parks, infrastructure, libraries or public safety. It will be given away to retired public employees, long after they’ve stopped serving our city.

If we don’t do something about it now, it’s going to get worse.

The other day we challenged retired police chief and $215,000 public pensioner Pat McKinley to put some real meat behind his dubious claim that he will “work to reform public employee pensions.”

Over the weekend we discovered a letter posted to McKinley’s website purporting to declare his position on pension reform. Exciting… until we read it. The letter actually commits to nothing and woefully understates the changes necessary to even begin correcting this problem.

Let’s run through Pat’s suggestions one by one. It’s important to note that McKinley’s letter says pension reform must contain ONLY ONE of the following:

Increase the amount contributed to the plan by Employee Contributions – Necessary, but wholly insufficient. While giving taxpayers some breathing room, demanding employees pay a little bit more does nothing to address the core issue, which is the unsustainable nature of pension guarantees when combined with the power of public employee union lobby. By itself, this change only slightly delays the pain.

Increase the amount contributed to the plan by Employer Contributions – Unbelievable. Increasing employer contributions is another way of saying we should raising taxes to pay for pensions. So now it would be safe to say that Pat McKinley wants to raise your taxes, but it’s really hard to believe he would write anything this dumb. For now, we’ll just assume that he has no idea what he’s talking about.

Slow the accrual of pension benefits by returning the formula to its previous level – Legally a change like this change can only be made for new employees, which would do nothing to address the massive unfunded liability that we have already accrued. Furthermore, it leaves the door wide open for future abuse when the unions become more powerful.

Slow the accrual of pension benefits by increasing the normal retirement age to reflect the longer life expectancies of our City employees – Same problem as above. The commitments we’ve made to current employees cannot be changed without a bankruptcy. The only lever we really have left salary and to a lesser extent, contributions. Cut salaries, raise employee contributions… or go broke.

Slow the payout of retirement benefits by lowering the Cost of Living Adjustment in retirement – The cost of living adjustment is about 2% a year. Reducing that, if it’s even legal in California, is hardly enough to sustain hundreds of public safety employee’s earning 90% of their final year’s pay for the next 30 years. And once again, there’s nothing to prevent another band of RINO’s from reinstating this benefit the next time CalPERS overstates its assets.

So what have we learned? McKinley has thrown out a bunch of half baked ideas to fool you into thinking that he wants pension reform, but it really boils down to almost nothing useful. And of course, even after writing this letter, McKinley has not committed to any pension reform.

We’ll say it again: Taxpayer-funded defined benefit plans must come to an end. The private sector learned long ago that they are completely unsustainable and also unnecessary. All new employees should be given defined contribution plans, while current employees should be made to pay as much as possible towards their own retirement, in order to mitigate the damage caused by their own unions and CalPERS through deception and poor planning.

By taking the more generous retirement plan that was presented to him as a County employee, Supervisor Shawn Nelson has created an onslaught of Internet outrage from the Blue and Red blogs.

Nelson says it was an accident. Was it? County policy requires that all new employees sign up for one of two plans: the old 2.7 @ 55 or the new 1.62 @ 65 that so far, almost nobody has signed up for at all. If you don’t choose, they will choose for you – 1.62 @ 65. Every single new hire in the County government is presented with this scenario.

In any case, Nelson’s decision highlights the dismal failure of Orange County’s alleged pension reform. When presented with two disparate retirement choices, what rational human being would pick the lesser?

If a guy like Shawn Nelson won’t do it, why would ANY public employee go for the option that is ultimately less generous – except, most likely, long-time employee pension abusers?

When union leaders originally hatched this goofy alternative plan, pension experts warned that new employees would not select a 401(k) style plan when offered alongside a traditional, elaborate government pension. Boy, were they right. But the unions and the supervisors went along with it anyway, just so they could notch pension reform in their pathetic pistol grips.

The bottom line: nobody wants a lesser benefit when they can choose a better one. Orange County’s much ballyhooed pension reform has completely failed because employees can simply avoid it altogether. What a joke.

But back to Nelson. He was presumably elected to represent taxpayers in union negotiations. I do not recall Nelson making any promises regarding his own pension. That would have been nothing more than a distraction from the real issue, as evidenced by Supervisor Pat Bates. Bates promised to not take a pension and followed through with it, but subsequently has done nothing to stop the real problem: runaway entitlements for every employee in the county! All 20,000 of them.

Dear Friends: The issue of Pension Abuse continues to dominate the National, State and local scene. If you haven’t already heard Jack Dean with Pension Tsunami speak on this important topic, hopefully today is a great relaxing day to do just that. Happy August 1st, 2010!

What valuable piece of manpower is worth paying over $200,000 per annum not to do anything?

If you guessed former Fullerton Police Chief Patrick McKinley you’d be right on the money. If there was ever a poster boy for out of control police pensions it would be Chief McKinley. See, the big guy pulls down a cool $96K a year from his old job at the LAPD that he’s been collecting since he left 17 years ago; then there’s the $118,000 he now rakes in from CalPERS, presumably from his time as Fullerton’s top cop.

Yipes! $215,000 a year in pension receipts; or about $18,000 a month; or $4100 every single week. More than he ever earned actually working. For the rest of his freaking life. If he lives another 20 years that’ll add up to $4,300,000 on top of what he’s already got, not counting cost of living increases.

Why is this important, apart from the obvious illustration of public safety pensions run amok? Because the word on Commonwealth Avenue is that Mr. McKinley is being promoted for City Council appointment to replace Shawn Nelson by Don Bankhead and Dick Jones – two other public pensioneers, one of whom is also a former cop.

In the RINO world of Bankhead and Jones this sort of thing is just hunky-dory. But for a lot of people – liberals and conservatives alike, the thought of this massive double dipper making pension decisions that affect Fullerton taxpayers is reminiscent of the fox guarding the hen house.

And of course we also remember McKinley as the police vest carney and vocal backer of the hideous Linda Ackerwoman creature.

Sorry guys. No sale.